Introduction: Dubai in a Changing Global Economy

The impact of global economic shifts on Dubai real estate market continues to shape investor decisions in Dubai.

The changes in the global economy are always a factor that influences investment strategies all over the world.

Thus, the real estate prices reacting quickly to the developments in the world.

Dubai, being a center of global business, has a very effective way of taking in these changes.

Hence, the property market in the city is still flexible, strong, and driven by new opportunities.

The Role of Global Economic Cycles

Global economic cycles are the main factors that determine how confident investors are in different markets around the world. During times when the economy is not doing so well, investors look for stability and long-term value. Thus, Dubai draws in capital from the investors’ side during times of economic uncertainty. In addition, the fact that Dubai has a varied economy minimizes its risk from the global markets.

Interest Rate Movements and Buyer Behavior

All around the world, central banks raise or lower interest rates to manage the inflation rate. Companies that operate in mature markets usually find that higher interest rates limit their borrowing ability. Nevertheless, Dubai enjoys strong cash buyers and flexible financing, which are the reasons for its stability. Therefore, the volume of transactions remains comparatively stable.

Global Inflation and Real Estate Demand

Inflation is a major factor that decreases the purchasing power of people in most countries. As a result, investors look for more secure investments such as real estate. Real estate in Dubai has been an asset that gives good returns through both renting and sales. Moreover, the apartment buildings have a continuous income flow due to the long-term leases.

Currency Fluctuations and International Investments

Changes in foreign exchange rates directly influence the decisions made regarding investments in different countries. A fall in the value of global currencies attracts investors in Dubai’s real estate. Thus, the foreign investors’ buying power is getting stronger. Such a trend leads to increased demand in all residential neighborhoods.

Capital Migration During Global Uncertainty

Economic uncertainty usually results in capital being moved to safer places. Thanks to Dubai’s good governance and regulations that are favourable to investors, Dubai is in a strong position. Consequently, global investors put security and transparency of assets as their first preference. Thus, Dubai becomes the most favoured location.

Geopolitical Tensions and Safe-Haven Demand

Geopolitical risks play a major role in shifting the investment trends and thus investors search for less risky places to put their money through diversified portfolios.

Dubai is a city that promises both political neutrality and connection with the rest of the region.

Such a positioning further increases its attraction as a safe haven for capital.

Government Policies Supporting Market Stability

Dubai’s government has taken various strategic reforms to adapt to global changes introducing long-term residence visas now lures in skilled workers and investors. At the same time, the new foreign ownership laws make the market more approachable. All of these efforts together build up investors’ confidence in the UAE.

Population Growth and Global Talent Migration

The relocation of global professionals is mainly due to the opportunities for a better lifestyle.

Dubai is pulling talent with its tax benefits and state-of-the-art amenities.

Consequently, there is a gradual rise in the demand for houses.

This pattern aids in the appreciation of residential prices in the long run.

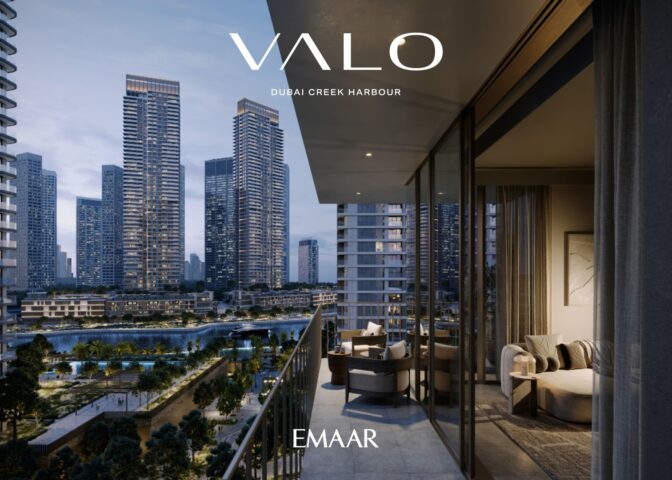

Off-Plan Properties and Investor Confidence

The uncertainty in the world promotes to invest strategically and in the long run.

On the other hand, developers use great payment plans to make risks smaller.

Thus, it is the case that off-plan projects are getting more and more investors.

Besides, investors are able to get the low prices that come with the early entry.

Rental Market Trends Amid Economic Shifts

Global living costs getting higher at a steady pace are the main reason for the rental market to keep its high demand. The city of Dubai attracting more and more inhabitants has directly caused the raising of the tenant activities. In this case, the profitability from rentals doesn’t go down and stays among the best around the globe. The trend gives the green light to income-oriented investment strategies.

Technology, Transparency, and Market Trust

The transaction transparency has been improved by digital platforms.

Access to reliable data is a must for global investors and thus they prefer such markets.

The trust of buyers is increased through Dubai’s regulated framework.

As a result, the participation of international investors continues to grow.

Future Outlook for Dubai Real Estate

The global economic transitions will still be hard to predict.

Nonetheless, Dubai is still doing economic planning in a very modern way.

Investments in infrastructure that are very reliable will definitely make the future ready.

In the end, the real estate market of Dubai still presents the possibilities of growth that are not going to be exhausted.

Conclusion

Ultimately, the impact of global economic shifts on Dubai real estate market continues to shape investor strategies and market demand.

However, Dubai benefits from strong governance, economic diversification, and global connectivity.

Therefore, international investors view the city as a stable and future-focused destination.

As global conditions evolve, Dubai’s real estate market remains resilient, adaptive, and growth-oriented.

Read More: Step-by-Step Guide to Buying Property in Dubai for Expats